Fact Splash Cyprus Economy in Numbers

|

| CPI deflation in services is most likely buoyed by “state services”. |

fortheisland.wordpress.com

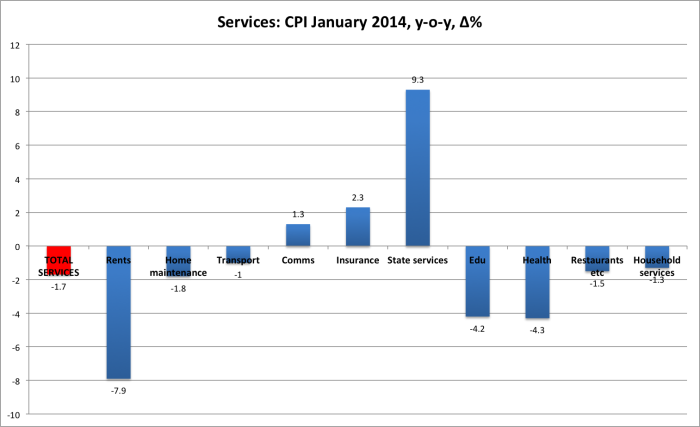

A bit more detail on the disinflation. All categories of services are in deflation or disinflation, except for star services, which are increasing quite drastically under MoU conditions. Impressive decline on rents, partially due to legislative intervention that forced reductions. We are also noting Health and Education, two of the main drivers of inflation in previous periods/years. Overall Services are deflating by 1.7%, versus the overall CPI decline of 2.9%, y-o-y for January (chart below).

ServicesCPIJan14

12 February 2014

More adjustment, continuing. With even deeper y-o-y CPI declines, the economy is still moving fast towards “internal devaluation”. Note that “core CPI”, which excludes fuel and edibles (the latter not on the chart) is even deeper in negative territory. Also note that domestic goods are showing deeper deflation than imports. The “traditional drivers” of inflation -health, education, rents, fuel- are all in disinflation except the latter.

cpijan14

|

Another sign of declining investment beyond the 33% or so we see in construction. While imports of inputs (including fuel, spare parts, cap goods and intermediate inputs) show a much steeper decline than consumption, non-saloon vehicles are also declining in scary numbers. Specialised vehicles (paving trucks, heavy trucks, cranes etc) have defined by 64% y-o-y versus 2012. Light commercial vehicles (not in the chart below) have also declined by 66.5%.

This is yet another piece of evidence that maximum growth is under pressure for 2014.

Vehicles

|

05 February 2014

One other big question, as unemployment crawls towards 20%, is how many of the jobs that have been lost represent job destruction and how many of them have simply moved underground. Given severe inadequacies in Ministry of Labor, legal shortcomings and risen part-time and contractual work, we have been expecting that the grey economy must have risen in 2013, and will continue to do so in 2014.

According to pre-crisis data (2011) from Min. Labor, inspections (mornings only) showed that undeclared work was endemic, around the 30% point in construction, tourism and agriculture. Data below from Eurofound.

Eurofound

|

03 February 2014

Them dollars: As expected, the foreign deposit inflow from last recorded month was reversed. This is because the foreign inflow was in USD, which makes about 20% of total deposits. USD deposits have always shown large oscillations, with deposits and outflows of as much as 1 billion moving into and out of the Cy banking system. For the most part, this is funds of regional businesses who use Cyprus as a transit centre for payments. Hence our unwillingness to join December’s celebrations over the inflow. The December outflow was natural, although we frankly expected this not to happen until last month.

On the other hand, overall deposits are stabilising, partly because domestic deposits are coming out of the pillow cases and partly because after outflows of 23 billion (32%), the outflow hd to stop at some point. This is the good news.

Deposits tot and USD

|

01 February 2014

In the light of ongoing discussions on the proposed local authority reform, it would be interesting to contemplate the comparison. Cyprus has 39 municipalities, plus smaller local authorities. The proposed reform revolves around the merger of local authorities into larger units.

From the Danish Ministry of Interior

|

Still some way to go: Government employees are declining overall, as per MoU obligations. There’s still some way to go to the reduction by 4.500 by 2016. Numbers are still cyclical with temporary/seasonal employees rolling in and out of service. the reduction at this point is mainly due to the “no replacement rule” for retiring civil servants, who are encouraged by increased taxes and the looming threat of taxing their five-figure lump sum payments upon retirement.

govemps

|

23 January 2014

The credit crunch was both dramatic and mild: This is one of the main explanations for how mild the recession has been in Cyprus despite the disappearance of two SIFIs and the double (banking and fiscal) crisis. Although we do see an overall reduction in credits by 12%, the credit crunch inside Cyprus has been very mild. Banks have been calling in loans abroad, rather than at home, so the overall credit restraint has not affected the domestic economy as much as expected.

We are expecting domestic credit crunch to pick up as large NPLs (of “the 30″ NPL holders who total 6b euro) start being called in) but this will skew the picture for households and for most businesses who continue to shed deposits, but remain still overall as far as total lending goes.

As banks burned this “fat” in their deleveraging, and as businesses and households have been burning up deposits, the economy could hold a growth rate at “only” -5.5% in 2013. The question is, how long can this go on, as the fat is running out.

Credit growth

|

21 January 2014

As expected building permits in 2013 to October (the most recent data recently released) show an overall decline y-o-y. Interestingly, the large category including health, spectacles, entertainment centres, education etc show a marked increase. We don’t believe that this reflects a casino license (data ends in October) or any of the planned new stadiums. University expansions are also very unlikely to be the trick, although some permits were extended in 2013 (we are expecting that they won’t be used any time soon). There are some obvious “candidates” that explain this, but we can’t be certain at this point as to what to attribute the growth to.

Note that the data below reflect value, not surface area or size of projects. As noted earlier, we are noticing fewer projects of larger size and value.

Also note that the category in question has a low basis, which overstates somewhat the increase, which is notable nonetheless.

building permits

|

19 January 2014

Another sign of the pressures in Cy business. The increasing leverage proxy seems driven from declining deposits as the credit crunch and dried-up liquidity is forcing businesses to burn the fact they’ve gathered in the good times. As BoC is pulling in some of the bigger loans from troubled businesses, total credits outstanding to cy business will also start to showing a decline. This is driven by a small number of large loan takers, however (30 businesses hold 6 billion in NPLs). Overall, indications show that businesses are still running down on their “old” deposits.

Cybusiness

|

16 January 2014

Good-ish news on the banking system. Overall lending abroad is growing marginally, driven by loans to other eurozone borrowers excluding Cyprus), and in third countries outside the Eurozone. Despite this slight upward tilt in lending abroad, total outstanding loans are flattening out. Inside Cyprus, deleveraging is still ongoing as banks are calling in loans from domestic borrowers.

This is goodish news because it reflects banks zeroing in on large NPLs: In BoC these amount to some 6 billion euro. As they are exchanged with locked-in deposits held by investors who take equity in large NPL holders, overall lending declines in Cyprus. At the same time, more lending abroad may translate to increased profits in later quarters. Hopefully.

Note that earlier (October) it looked like the opposite was happening- deleveraging was taking place mostly abroad, allowing Cyprus to by-pass the credit crunch as most of it took place in loans extended to non-cypriots. Now large NPL holders are skewing the picture as their loans are called in, while banks are lending in ez and third countries again.

deleveraging

|

15 January 2014

One of the most important reasons to worry about 2014. As noted in earlier splashes, inputs and capital goods (mostly imported) are declining. We know that the economy is dissaving and that stocks have declined for the first time in Q3, whereas Q4 is the usual “destocking time”. With input imports declining, and with capital goods coming in slower, productive capacity is probably declining, pulling maximum potential GDP inwards (thinking in terms of production possibility frontier).

Intermediate inputs and capital goods have declined by 30.9% overall, year-to-November.

Another concern is that, with the credit crunch still continuing, with bank guarantees, credit notes and the like not accepted as readily from exporters, and with businesses being increasingly illiquid and increasingly leveraged, the question is whether they can restock as much as they need, and wether input and capital imports can cover the slack in 2014.

Note that consumption imports have declined by significantly less than “productive” imports. Also note that most of the inputs and capital goods are imported

importsgrowth

|

12 January 2014

Decline in prices in the year to November shows that, with the exception of fuel, which is exogenous, there is a disinflationary trend across the board. Fuel inflation will probably remain high, driven by new taxes, but the data jibes with what we are seeing from other figures. December and annual data for 2013 show that the trend seen to November isn’t changing.

So internal devaluation is seen in yet another set of data. Good news, in most respects, especially regarding competitiveness.

Interestingly, as disinflation is taking hold, another thought is that euroexit’s main goal (devaluation and competitiveness) is already happening.

CPI largecats

|

09 January 2014

Does Eurostat’s metric dispel tax myths? Interesting numbers, although the definitions are a bit fuzzy. In any case, real tax burden is higher than often assumed, with a host of labor taxes, “defense” tax, local taxes etc increasing total burden.

implicit tax rate

|

07 January 2014

Job losses, in absolute numbers, concentrate in trade, construction and manufactures. It’s highly unlikely that they’ll ever return in the latter two categories, given the displacements we are seeing in the economy. In trade, we might expect some job creation, but that will be over the next few years, and in new categories (re-exports, shipping-related, bulk-and-wholesale) rather than the retail bubble that was fueled by consumer credit growth. As such, many questions arise about the unskilled labor employed in retail.

Overall, it looks like unemployment might be approaching its climax slowly. Some more job loss should be expected in trade and in MFIs still. Services (scientific and professional) started adjusting long before the crisis, so there shouldn’t be a marked increase later on.

The big question is how many of these job losses are actually lost, rather than moved into the grayer parts of the economy. The latest inspections of Labor Ministry found up to 25% of employees were not registered in inspectors’ “working hours” (till 14.30), while the few inspections that took place in the afternoons puts the number at 33%. These are 2011 figures, concentrating in agriculture, construction and tourism. With no real campaign taking place against illegal and/or unregistered work, these numbers should be expected to be much higher today.

joblossQ3

|

06 January 2014

We’ve talked a bit about destocking before. Available data shows that shocks have declined in Q3. Historical data show that net destocking has never taken place before Q4 before, and Q4 is always a time for destocking, both for retailers (Christmas, presumably) and for other stocks (inputs). The fact that there are more stocks consumed than brought into the economy starting in Q3 should translate to dramatic stock reductions for 2013.

The big question relates to the restocking that has to follow. Although the cap controls allow spending on imports, credit notes, bank guarantees and other instruments are increasingly not accepted and foreign exporters demand cash advances or payments on order. Given that businesses are both leveraged (loans-to-deposits at 423%) and illiquid, the credit crunch should be taking a pinch on them as of Q1 this year.

This is one issue that needs to be tracked closely.

destocking

|

o4 January 2014

More adjustment: Labor Cost Index is showing fast adjustments, in the midst of increasing unemployment. Labor working hours are remaining lately constant, with full-time workers working an average of only 28 or so minutes more per week than a year ago. CPI is moving on similar trends, with the year closing in negative territory for the first time since 1964.

Interestingly, there seems to be a small increase in part-time work compared to full-time work, with employers preferring part-time workers and employees taking whatever they’ll find. Overall, however, LCI figures are showing that the economy is fast adjusting to the new conditions, boosting competitiveness.

“Internal devaluation” proxies are showing almost in every metric.

lci

|

Read the rest of the article, regarding the year 2013, on the following link........

fortheisland.wordpress.com

Comments

Post a Comment