Letter from Cyprus: Economic rebels win the argument

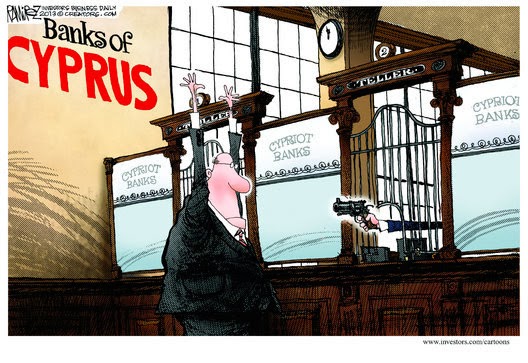

Agia Paraskevi is probably the busiest square mile in Nicosia. Two large buildings loom, uninspiring but imposing. From here the economy of Cyprus is run and was ruined by Bank of Cyprus, the nearly broke bank that was bailed out by taking depositors’ money for its rescue, and the Central Bank, heavily criticised for its extension of emergency liquidity to Laiki, a now defunct bank, even as it was manifestly insolvent.

Next to these is the Hilton, teeming with foreign investors flying in to rescue (or to “vulture”, as some put it) troubled Cypriot companies.

Between these is the twin church of Agia Paraskevi, one small old limestone building mirrored in a larger, modern copy created to fit more believers, its bells ringing hope as yuppies and bankers pass by, indifferent to its chimes.

These men end up in the most strategically placed café of the country, where former Bank of Cyprus senior managers (now unemployed), Central Bank senior staffers, start-up owners and businessmen meet.

Bank of Cyprus is owed €6 billion in bad loans, most of them not performing since before the crisis, and held by no more than 30 businessmen – most of them real estate developers who overstretched in the upswing and are now unable to service their loans.

This was the original sin in the Cypriot economy. It was the great equaliser.

On the one hand, civil servants and bank employees, members of unions that would make Margaret Thatcher shiver, enjoyed a guarantee that, once they had secured a job, they were certain to retire with a generous pension.

In the private sector, lower salaries and minute pensions created pressure to keep up with the Joneses who had secured social mobility by joining the mandarin class. And this is where the banks came in. With low interest rates, and a lax attitude to repayments, banks allowed much of the private sector to keep up. If a business could not repay its loans, it could always “restructure” them by evergreening old ones and securing a new loan that wouldn’t come due for years. Hence business grew and banks looked strong, logging profits and pushing bad loans into future due dates.

Excessive lending and fiscal recklessness now require contrition. Former bank employees are “shocked that gambling was taking place”. Civil servants are shocked that productivity was so much lower than salaries. But most shocking for them is that the social elevator, guaranteed only to go up, is now descending.

In the café also sits another class of young professionals. Cassandras who had warned that someone needed to take the punchbowl away from this party.

One latte-sipping, American-educated PhD is talking about risk management in the banks. “All that mattered was collateral. And it was always deliberately overvalued,” he says. He is now a senior risk manager in the banking system.

They are all close acquaintances of the Finance Minister, who dared take a budget with 10% cuts to the Parliament. The MPs obliged, grudgingly.

Now the heretics are invading the Vatican of the economy, taking over key positions in banks and government, regulating financial institutions and sitting on boards.

Meanwhile, a developer, who held more than €200 million in bad debts and received another €200 million in loans after the crisis struck, is wandering the Finance Ministry corridors, muttering that “the bank is ruining growth” because it won’t give him more time to repay. Never mind that he was connected to the board of the bank…

“Even if he’s not going to jail, these guys are losing their grasp in the economy,” said a “rebel”, who has just registered a start-up devoted to troubled asset sales.

Letter from Cyprus: Economic rebels win the argument

Michalis Persianis efinancialnews.com

20 Jan 2014

Comments

Post a Comment